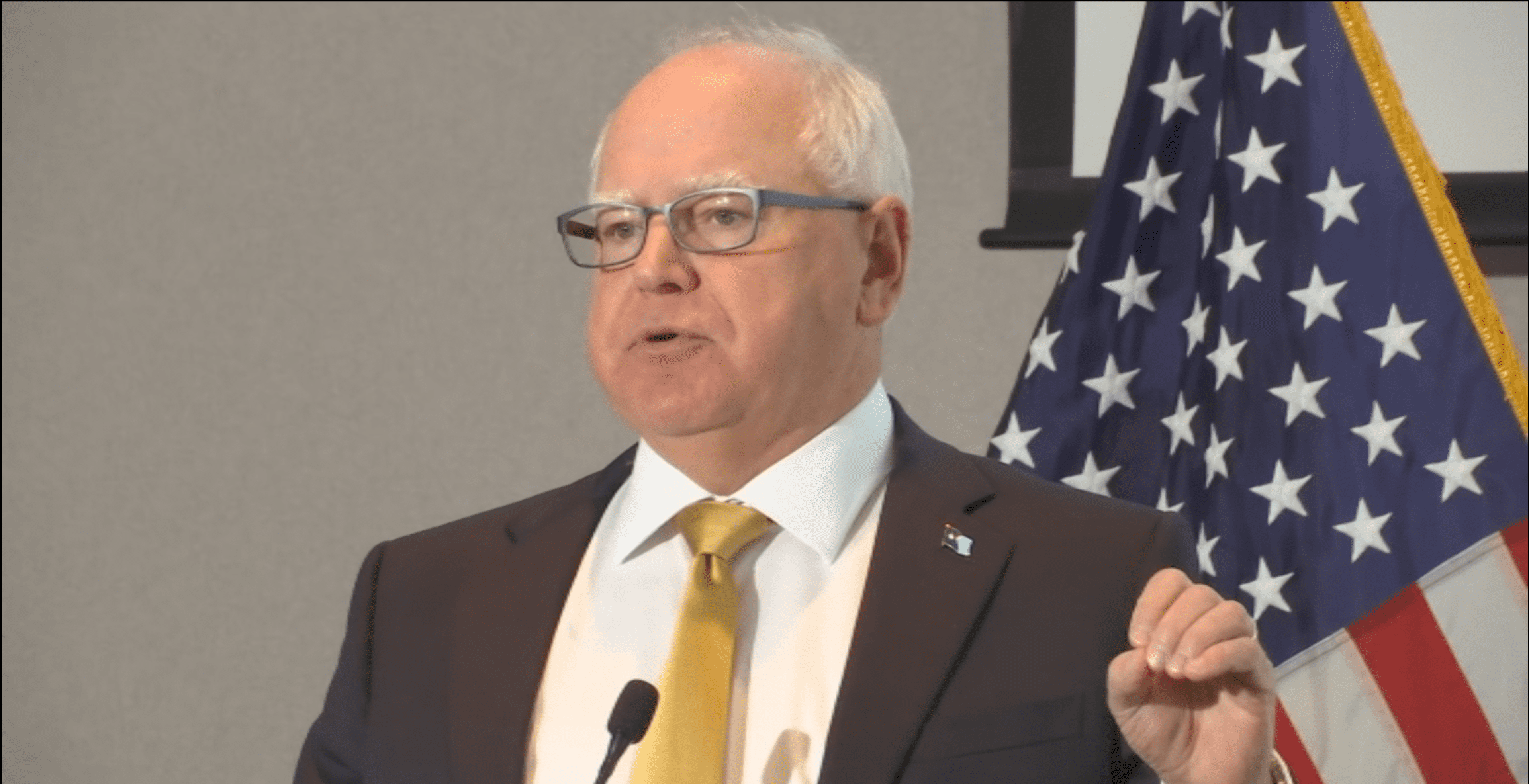

Gov. Walz releases revised Minnesota budget proposal

Minnesota Governor Tim Walz released a revised budget proposal for the state on Friday, March 21. The budget is for the next biennium and includes just under $250 million in additional ongoing reductions for fiscal year 2028-2029.

“This budget is fiscally responsible and prioritizes the programs that will set Minnesotans up for success for generations to come,” said Gov. Walz. “By addressing the budget challenges we face today, we’re setting Minnesota up for long-term success and protecting the resources necessary to make Minnesota the best state to live, work, and raise a family.”

The Governor’s office further states that the revised budget will support the state’s response to Avian Influenza and provide additional funding for law enforcement training. The budget will also leave over $2 billion on the bottom line for fiscal year 2026-2027, including around $250 million in additional ongoing reductions for fiscal year 2028-2029.“The revised budget curtails spending growth while maintaining key services that improve Minnesotans’ lives,” said Minnesota Management and Budget Commissioner Erin Campbell. “This budget is fiscally responsible and recognizes the need to take action now to address the imbalance in revenues and spending long-term.”

Additionally, the Governor’s office said the budget will limit year-over-year growth rates in Medicaid waivers with limiting eligibilty for services. They said this will save the state more that $1.3 billion. There will would also be cuts to state funding to private schools, including a 5% reduction in Special Education transportation reimbursement costs, saving approximately $50 million in each of the next two-year budget cycles.

Statewide sales would also see a reduction of .075%, which would be the first sales tax cut in state history.

“He also proposes closing loopholes by expanding the sales tax base to services provided to individuals by investors, bankers, and lawyers, making the tax system more fair and less regressive,” explained a release from the Governor’s office. “Additionally, the budget proposes an investment in a new corporate franchise tax division unit to audit complex pass-through entities and close loopholes. The budget also proposes an increase in the surcharge currently levied on health maintenance organizations from 0.6% to 1.25% of total premium revenue, to ensure large health care corporations pay their fair share.”

Governor Walz also proposes to shift the responsibility for the state share of reinsurance to insurers rather than taxpayers.

Full details on the revised budget proposal can be found here.