Superior home values mean tax hikes for some

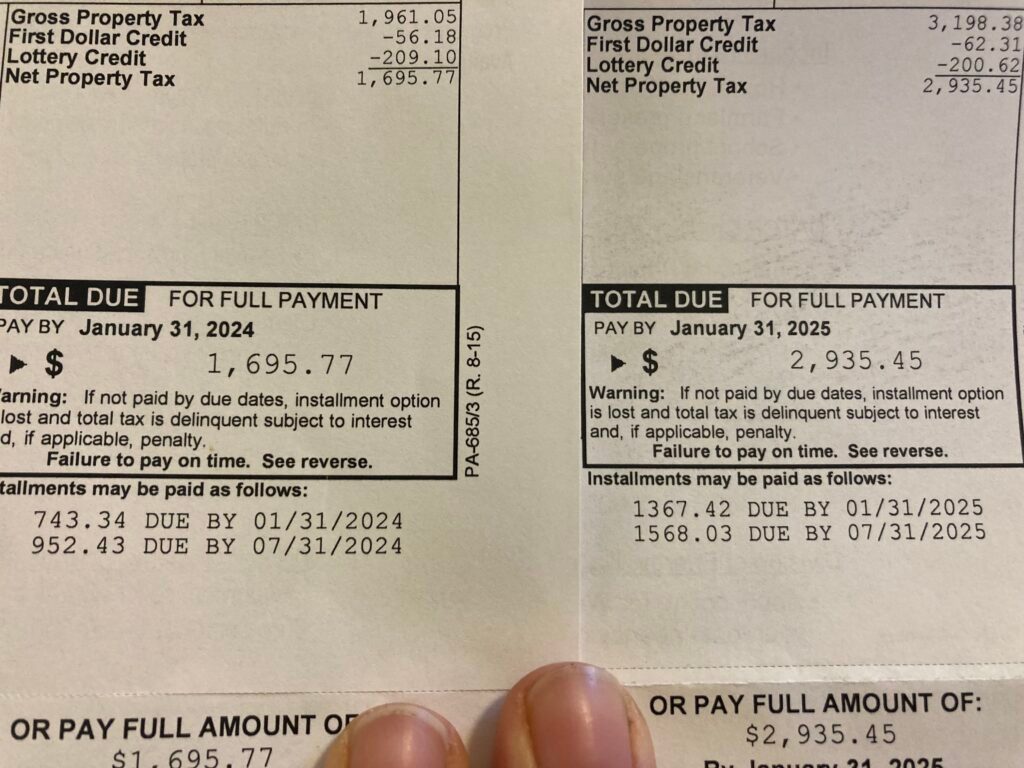

Thanks to a recent property value revaluation in Superior, many home and business owners are seeing their property values increase. For some however, this means a higher bill when it comes to tax time.

“Value increases were much higher than the average, those people got much bigger bills. And admittedly, it was much larger than I expected. And so that’s really disappointing.” Said Superior’s Mayor Jim Paine. He says increased tax bills are falling mostly on single-family homeowners.

“The value of single-family homes increased astronomically over the past few years. And it far outpaced the increased value of any other type of property, like multifamily or commercial or industrial or manufacturing. The single-family home has become the single most valuable piece of property in Superior.” Paine explained.

While the Mayor says that the city taxes haven’t increased, an increase has come from the School District of Superior. In November, Superior voters passed measure approving an five-year referendum to help pay for operational costs.

School District officials say the referendum for this year equates to about $4 per $100,000 of property value – a house worth $300,000 would see a school property tax increase of around $12.

“The alternative would have been, if we said we did not want to increase the tax levy at all, would to be to go into the hole by $3.6 million,” said David See, Superior District’s Director of Business Services, “The closing of an elementary school saved us a million dollars. Without that referendum, our students would have a lot less opportunities than many of the other kids in the state.”

Mayor Paine says that property value reassessments happen infrequently, and that the city is working to keep taxes low.

“We have to do everything we can to keep all our other bills low and to make sure that this is an isolated year. This should only happen this year. It has not happened the last years. It will not happen the next few years. This is a one-time adjustment. And hopefully, we can go another 20 years before we have to do this.”

The mayor added that those with concerns about tax bills can contact the city to have questions answered. Superior’s website also has an FAQ about the revaluation.