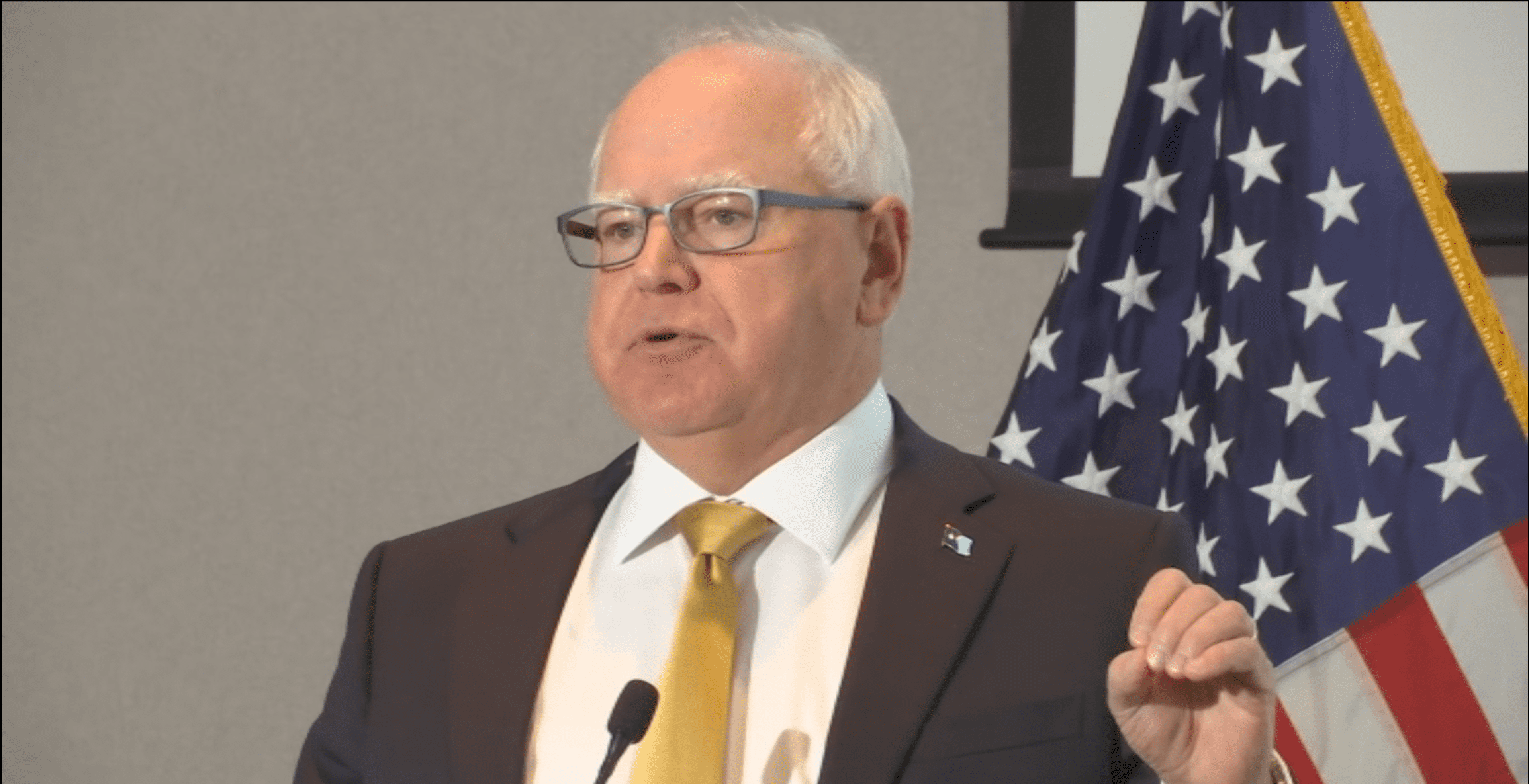

Walz proposes first sales tax cut in state history to balance budget

Governor Tim Walz and Lieutenant Governor Peggy Flanagan presented their 2025 biennial budget on Thursday, January 16. As per Walz’s office, the budget includes the first sales tax cut in state history and closes tax loopholes for services offered by wealth managers and lawyers.

Walz also states that the budget combats fraud and sets Minnesota up for success for years by curbing spending growth in the programs that drive the structural deficit.

“This budget is responsible, measured, and honest, and it starts with one goal: fiscal responsibility,” said Governor Walz. “Our plan sets Minnesota up for success in the future by addressing long-term budget challenges and protecting the investments we made to improve lives, including universal meals, paid family and medical leave, and tax cuts for seniors and middle-class families.”

Lieutenant Governer Flanagan also highlighted a focus on stability and protecting investments in families. She said these investments help support those who need it most while also allowing possible spending in supporting neighboring states.

“We are providing Minnesota with a strong economy and stability for years to come building on investments in children and families from 2023,” said Lieutenant Governor Flanagan. “Our dedication to providing services and support for those who need it most remains consistent. This budget is centered on managing spending in areas we know will grow. Minnesota has always been and will remain a generous state, one that is committed to helping our neighbors.”

The proposal is supported Erin Campbell, Minnesota Management and Budget Commissioner

“The Governor’s budget proposal does exactly what we need,” said Campbell. “It addresses the structural imbalance between revenues and expenses, brings spending on the fastest growing programs in the budget to more sustainable levels, broadens the sales tax base while providing the first-ever rate reduction in statewide sales taxes, and creates a projected positive balance – not only in the next biennium but also in the following one.”

Other features of the budget highlighted by the Gov. Walz include a limit on year-over-year growth rates in Medicaid waivers without limiting eligibility for services. Walz’s offices states this will save the state more than $1.3 billion. The budget also includes cuts to state funding to private schools, including a 5% reduction in Special Education transportation reimbursement costs, which they believe will save approximately $50 million in each of the next two-year budget cycles while incentivizing schools to create efficiencies in transportation.

Along with the limits to waivers and cuts in state funding for schools or transportation for schools, they also proposed cuts on statewide sales tax.

The Governor and Lieutenant Governor propose cutting the statewide sales tax by .075%, which would be the first sales tax cut in state history. They also propose closing loopholes by expanding the sales tax base to services provided to individuals by investors, bankers, and lawyers, making the tax system more fair and less regressive. Additionally, the budget proposes an investment in a new corporate franchise tax division unit to audit complex pass-through entities and close loopholes.

The budget also proposes an increase in the surcharge currently levied on health maintenance organizations from 0.6% to 1.25% of total premium revenue, to ensure large health care corporations pay their fair share.

Additional details on the budget can be found here and on the Minnesota Management and Budget website.